what is fit on a pay stub

This is just a way to save time and space on your pay stub. Some are income tax withholding.

What Everything On Your Pay Stub Means Money

But if you find yourself living paycheck to paycheck and need to.

. You will receive a pay stub for each pay period. I tried googling but cant figure. Decoding Pay Stub Abbreviations.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Pay Stub Deduction Codes What Do They Mean. If you are like most people your paycheck means only one thingmoney in the bank.

What does FIT gross mean on paystub. The FICA taxes you pay for Social Security are equal to 62 of your gross earnings each pay period. A pay stub is a piece of paper or online document with lists of information about your salary.

Common pay stub deduction. Was just looking at my husbands recent pay stub and for earnings it has 40k but under that it says FIT gross at 38k. This is required and the payroll system automatically enrolls employees into the FIT deduction.

When you reach this. Fit stands for Federal Income Tax Withheld. FIT stands for federal income tax.

FIT deductions are typically one of the largest deductions on an. FIT Federal Income Taxes. Payroll companies abbreviate the information that is printed on your pay stub to reduce it and make it.

Pay Stub Abbreviations are the abbreviations that you come across on any pay stub. The taxable pay is a reflection of the current tax codes and allowable deductions. What is the difference.

Your net income gets calculated. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. On my paystub I have deductions listed as.

For example a single employee making 500 per weekly paycheck may have 27 in federal income tax withheld per paycheck in 2021 if the employer uses the wage bracket. FIT on a pay stub stands for federal income tax. A pay stub also known as a paycheck stub or pay slip is the document that itemizes how much employees are paid.

They are all different taxes withheld. What is FiT taxable wage. FIT is applied to taxpayers for all of their taxable income.

Fica ficm fit sit tdi. You are going to see several abbreviations on your paycheck. Answer 1 of 2.

Below you will find some of the most common deduction codes that appear on your pay stub. You will pay this tax on all your earnings up to 137700. The FIT deduction would only be stopped in the event of a.

But when you are trying to decipher. If you have a retirement account a proportion of your pre-tax earnings will go into your 401k or IRA. A pay stub which is also commonly referred to as a paycheck stub or payslip is an important document that contains the details of the wages or salary disbursed to an employee.

Like other deductions retirement account contributions are pre-tax dollars. For the IRS the taxable pay is the federal adjusted gross income. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

The Federal Income Tax is progressive so the amount will. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. In the United States federal income tax is determined by the Internal Revenue Service.

It will state what your gross pay is what deductions are being taken from your pay.

Hrpaych Yeartodate Payroll Services Washington State University

A Pay Stub Or Paycheck Stub Is A Document That Is Issued To By An Employer To His Her Employee As A Notification That P Payroll Checks Payroll Payroll Template

A Guide On How To Read Your Pay Stub Accupay Systems

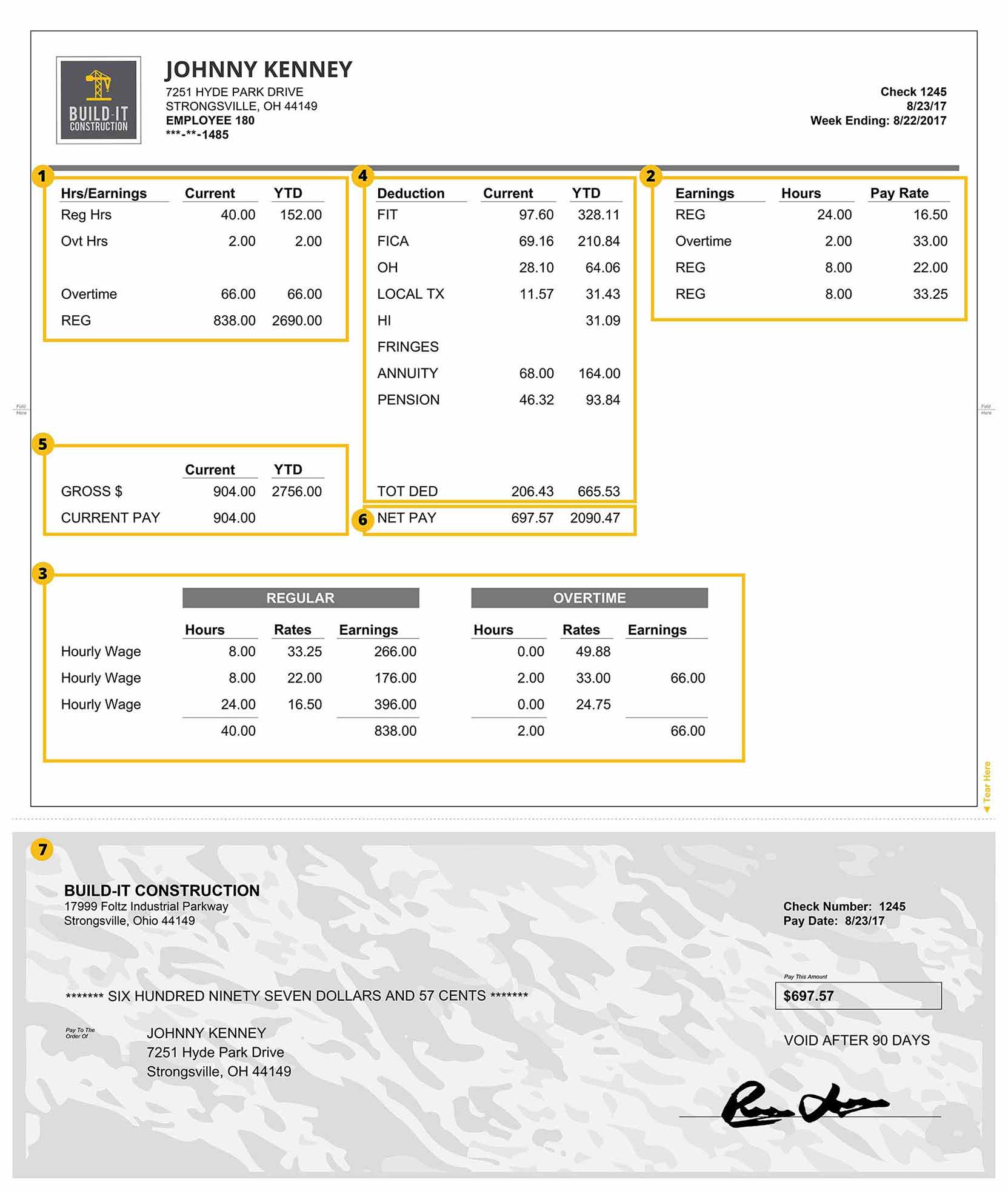

A Construction Pay Stub Explained Payroll4construction Com

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

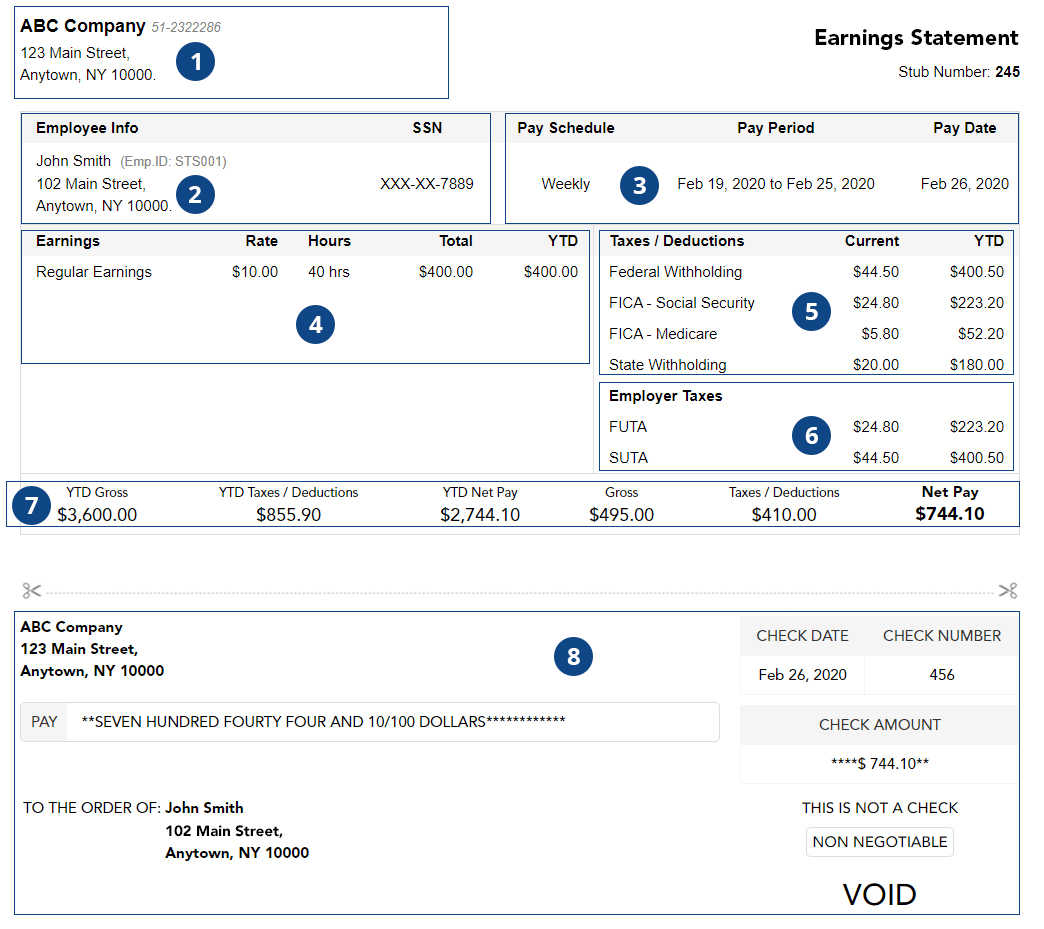

Understanding Pay Stub Understanding Paycheck Stub

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Create Paycheck Stubs Resume Template Free Statement Template Payroll Template